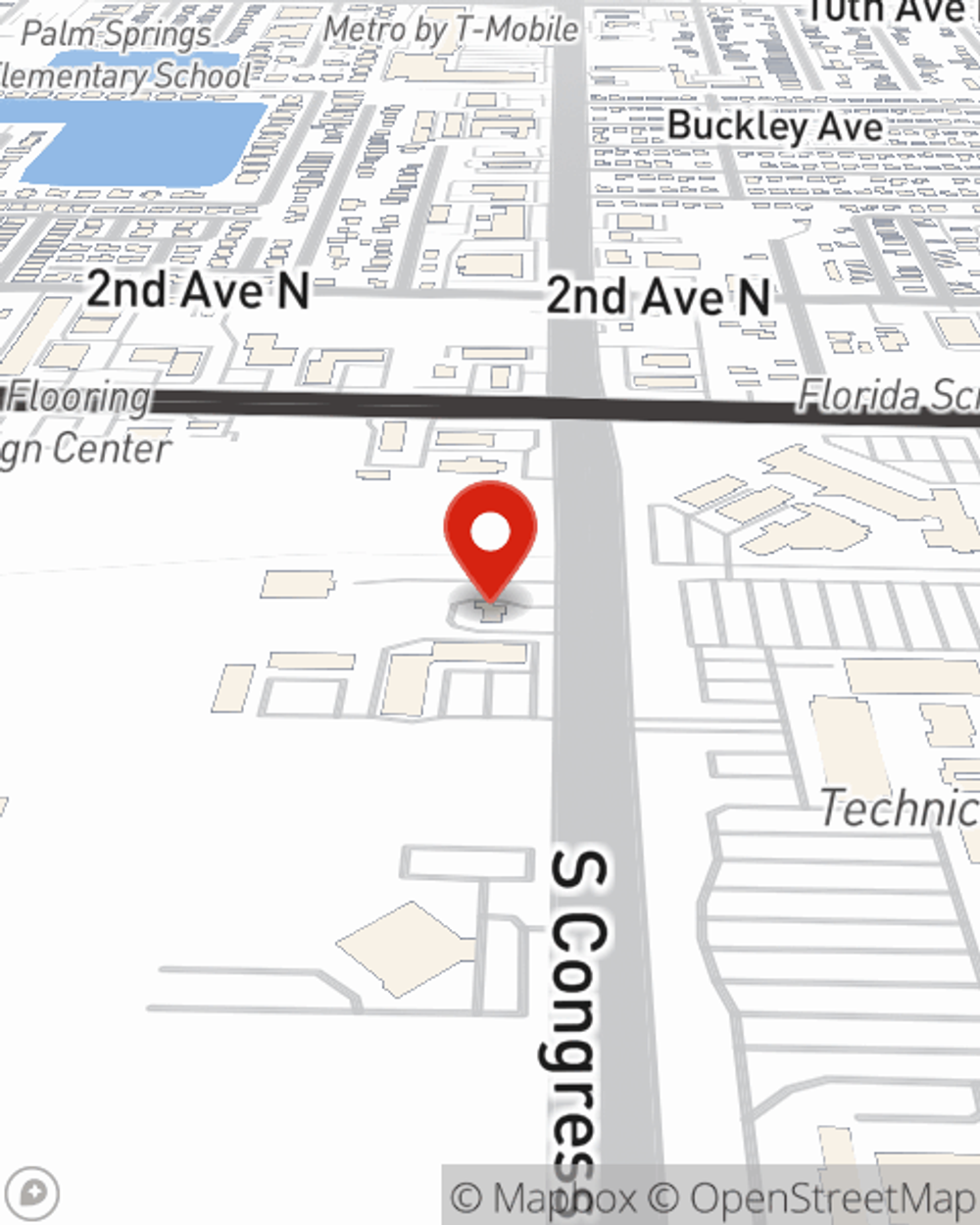

Business Insurance in and around Lake Worth

Calling all small business owners of Lake Worth!

No funny business here

- Broward County

- Palm Beach County

- Lake Worth Beach

- Royal Palm Beach

- Miami Dade County

- West Palm Beach

- Fort Pierce

- Tequesta

- Del Ray Beach

- Doral

- Jupiter

Help Prepare Your Business For The Unexpected.

Operating your small business takes commitment, dedication, and outstanding insurance. That's why State Farm offers coverage options like worker's compensation for your employees, a surety or fidelity bond, extra liability coverage, and more!

Calling all small business owners of Lake Worth!

No funny business here

Strictly Business With State Farm

Whether you own a HVAC company, a photography business or an ice cream shop, State Farm is here to help. Aside from exceptional service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Ready to review the business insurance options that may be right for you? Reach out agent Paul Roca's office to get started!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Paul Roca

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.